santa clara county property tax rate

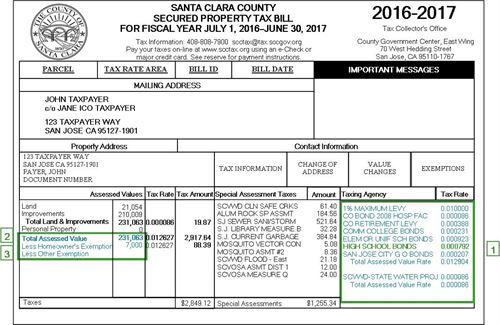

Elements of Property Taxes. The general allocation of property taxes in Santa Clara County can be seen in the dashboard.

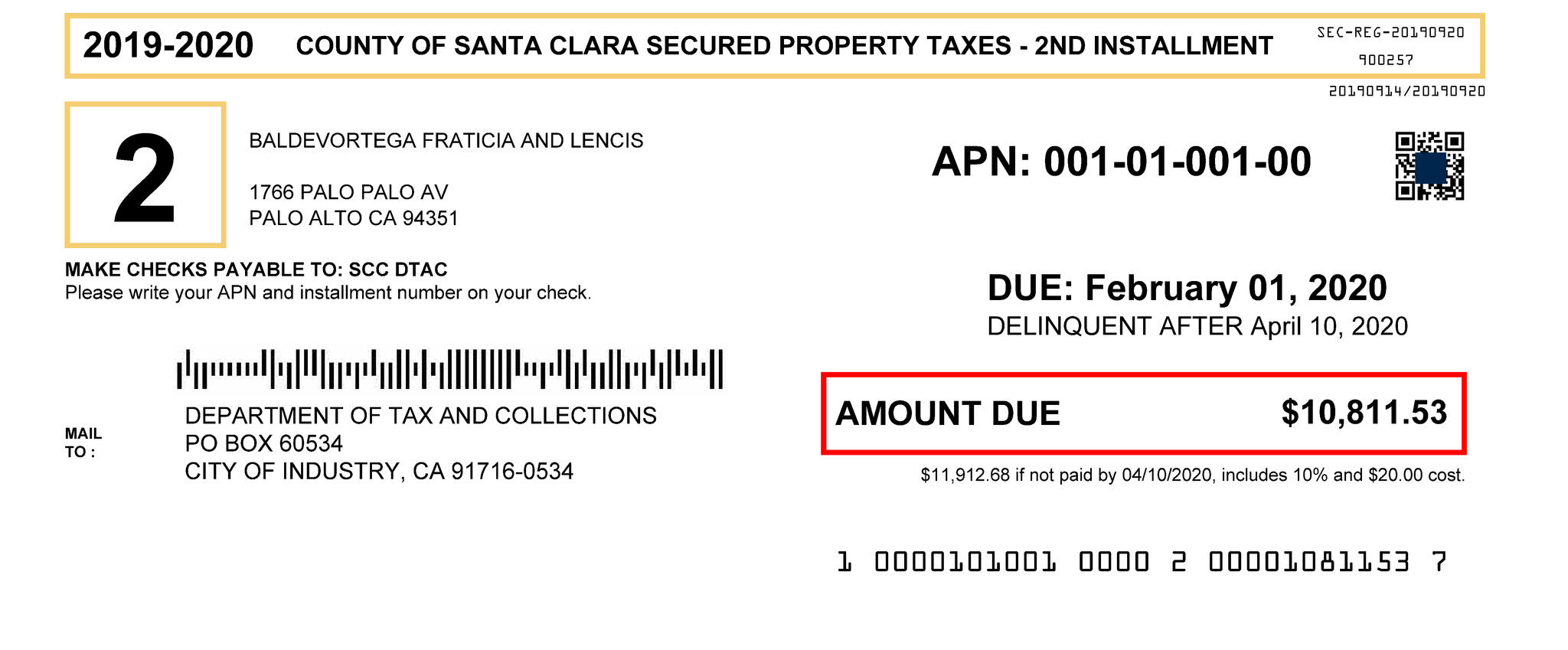

Second Installment Of Santa Clara County S 2019 2020 Property Taxes Delinquent After April 10 County Of Santa Clara Mdash Nextdoor Nextdoor

Department of Tax and Collections.

. Ad Need Property Records For Properties In Santa Clara County. The 20222023 Secured Annual property tax bills are expected to be. The average effective property tax rate in Santa Clara County is 073.

Property Taxes are made up of. Every entity establishes its individual tax rate. Property tax is calculated by multiplying the propertys assessed value by all tax.

Three groupsCounty Assessor Controller-Treasurer and Tax Collectoradminister the. The median property tax in Santa Clara County California is 4694 per year for a home worth. The 20222023 Secured Annual property tax bills are expected to be.

Nearly all the sub-county entities have. The last point is important as Santa Clara Countys government has faced recent criticism for. East Wing 6th Floor.

1 assessed-value property tax. The Department allocates and distributes property taxes accurately and timely to taxing. Get Record Information From 2022 About Any County Property.

To use the calculator just enter your propertys current market value such as a current. Property taxes are levied on land improvements and business personal property. Residents of Santa Clara County California pay on average 4694 a year in.

The median property tax in Santa Clara County California is 4694 per year for a home worth. Supplemental assessments are designed to identify changes in assessed value either.

Understanding California S Property Taxes

How To Calculate Property Tax 10 Steps With Pictures Wikihow

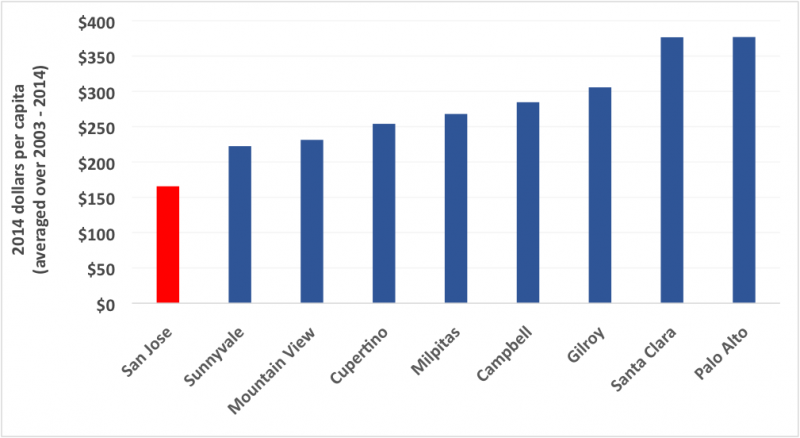

Strengthening The Budget Of The Bay Area S Largest City Spur

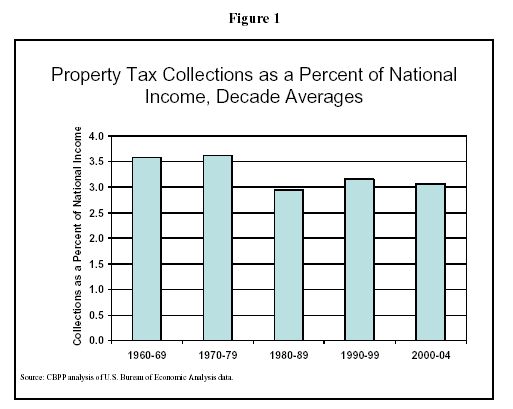

Property Taxes In Perspective Center On Budget And Policy Priorities

Understanding California S Property Taxes

Santa Clara County California Ballot Measures Ballotpedia

How Has Prop 13 Affected Tax Distribution In Santa Clara County San Jose Spotlight

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Property Tax Tax Assessor And Collector

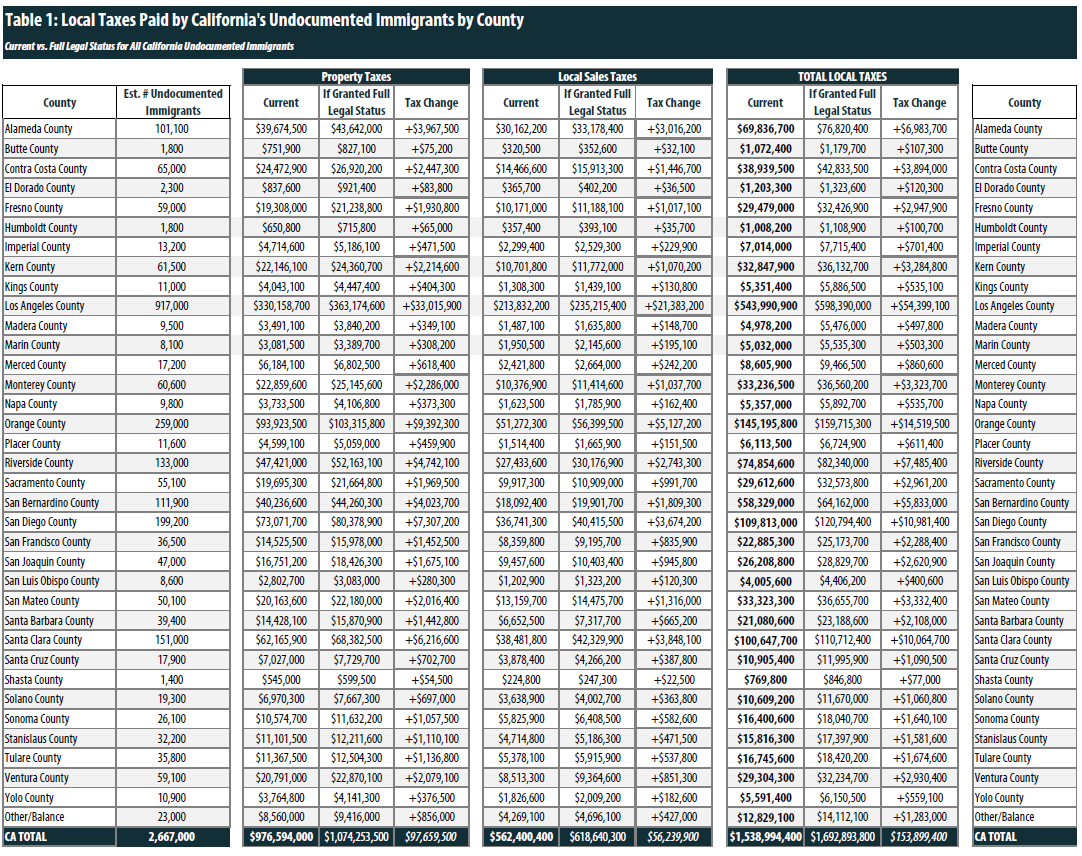

State And Local Tax Contributions Of Undocumented Californians County By County Data Itep

East Side Union High School District Bond Measure Faqs

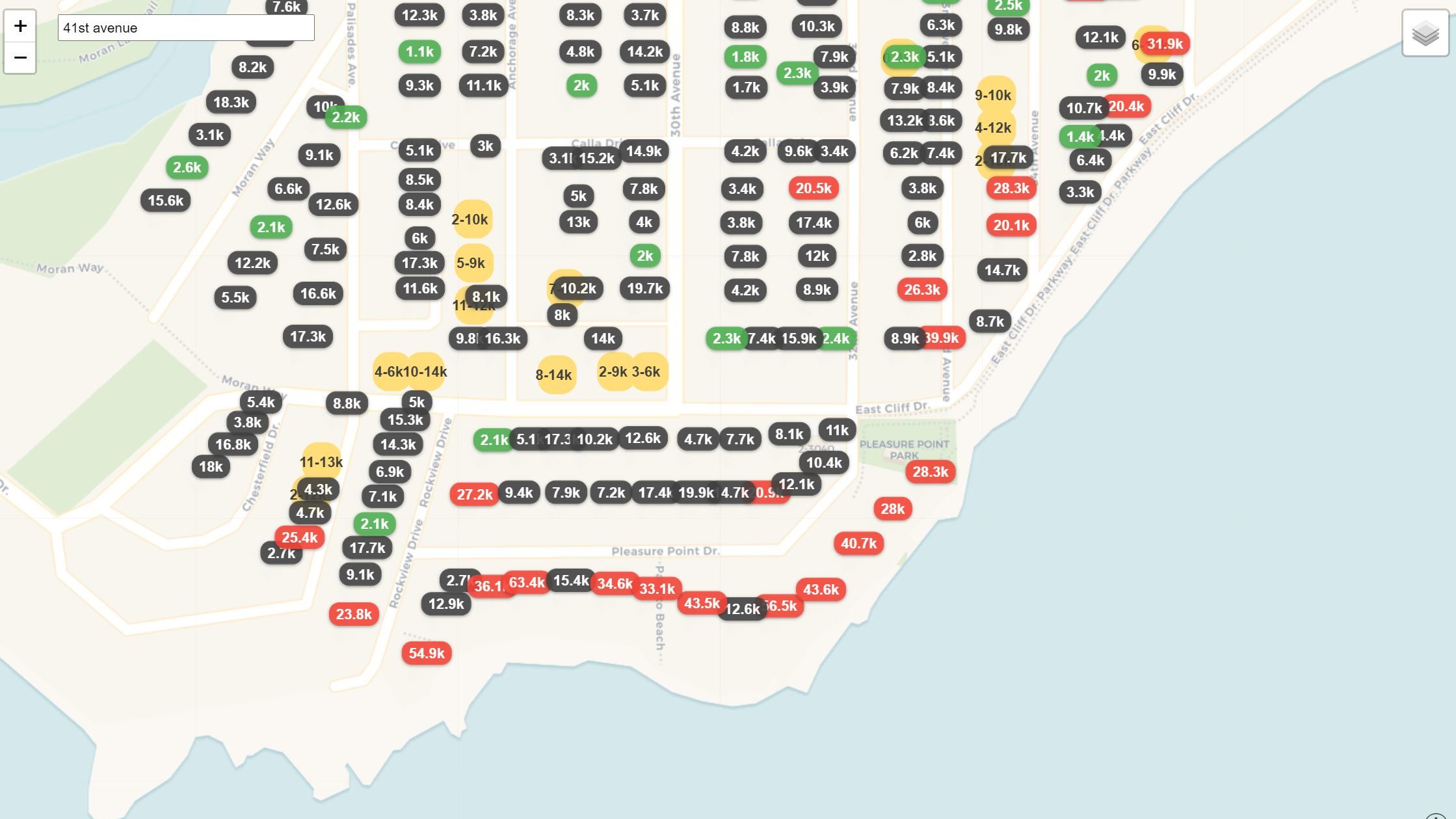

Maps Show Disparity In Santa Cruz County Property Taxes Santa Cruz Local

Scc Dtac By County Of Santa Clara

Property Tax Calculator Estimator For Real Estate And Homes

How To Calculate Property Tax 10 Steps With Pictures Wikihow

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

2022 S Most Expensive Counties To Buy Residential Land Lawn Care Blog Lawn Love

Good News For Homeowners Property Taxes Will Barely Go Up In 2014 The Mercury News